US Payroll 2011 Round 1 Tax Tables Update

While going through discussion points in Dynamics GP forums, I observed the queries on Payroll (US) 2011 Tax table update is on a rising trend. Most clients have updated their tax tables to 2011 tables before closing out the year 2010. Adding to this, the new tables included FICA update which calculates Employee FICA SS @ 4.2%, the new rate instead of 6.2%. Since Dynamics GP calculation is based on one rate, both employer and employee rate is set @ 4.2% while it should be 6.2% for employers contribution. The workaround was to pass a GL adjustment for the remaining employer’s contribution. However, A Round 2 Tax update is planned to be release d by January 24th which is supposed to take care of this issue.

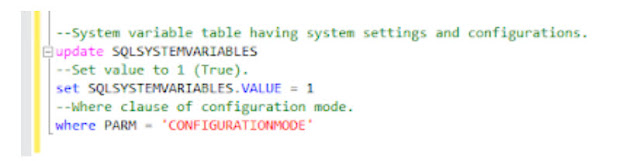

It seems some clients have updated with 2011 tax tables before closing 2010 year-end. This might give errors on W-2 validation report. The fix to this issue as suggested by others is to download and install Round 7 tax update for 2010 and to re-install 2011 update once the 2010 is closed and ready to do the 2011 pay run.

Here is the link to Round 7 Tax Update. Also refer to KB 850663 for year-end closing procedures for Dynamics GP payroll.

Other Posts on FICA Update

FICA SS Withholding Information for Dynamics GP

Disclaimer: Information in this post is based on information from the discussion groups.Advised to make proper backups and test in development environment before rolling the updates. Also advised to consult the Partner or Microsoft Dynamics GP representative.